Employees stress less with on-demand pay

Did you know that 56% of working Canadians are living paycheque-to-paycheque?1

When your employees are financially unwell, productivity, engagement and retention suffer—and so does your business. ZayZoon takes the financial stress out of work by bringing your employees on-demand access to their earned wages.

Employees at these companies trust ZayZoon

Payroll for today’s worker

Earned Wage Access (EWA), also called on-demand pay, is revolutionizing payroll as we know it. Employees are no longer bound by traditional weekly, bi-weekly, semimonthly or monthly pay periods. With on-demand pay, they're free to access a percentage of the wages they've already earned whenever they want.

The benefits of on-demand pay

Besides introducing more control and financial stability into the lives of your employees, on-demand pay can help you...

With Earned Wage Access, you’ll attract 2x more applicants than your competitors.3

Businesses experience up to a 29% reduction in turnover thanks to Earned Wage Access.4

Tired of processing payroll advances? On-demand pay is free, and easy to offer.

Redefine the employer-employee relationship

When workers know you've got their back, they'll give you their best. ZayZoon's financial empowerment platform helps you prioritize employee financial wellbeing and prove you care.

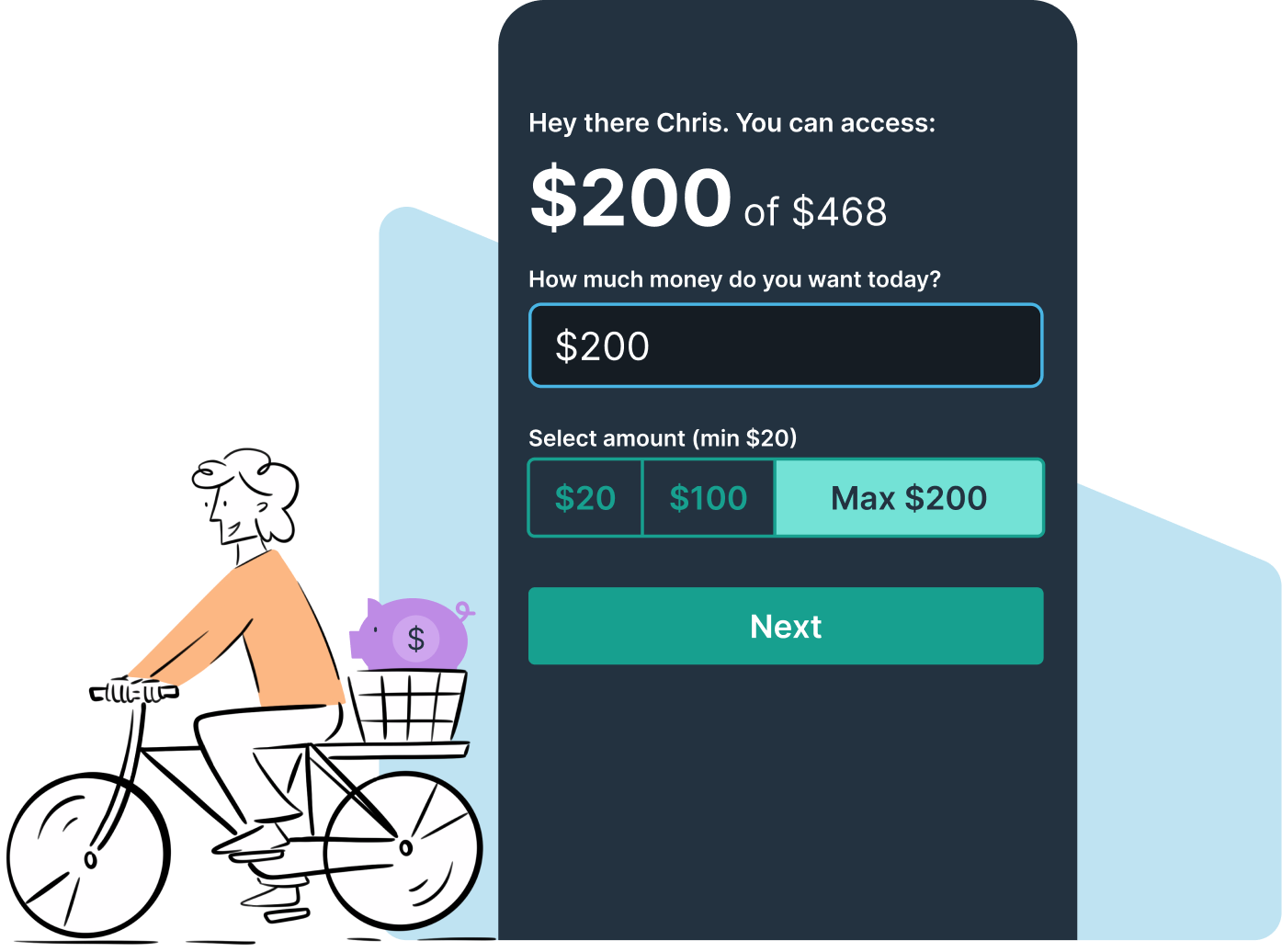

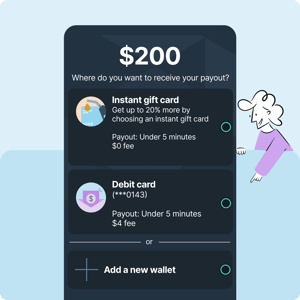

Employees can’t wait for payday. Now they don’t have to.

Employees want to control when they get paid and how. With ZayZoon Earned Wage Access, they finally can—and you don't have to lift a finger. When payday's any day, workers get the cash flow they need to handle any unexpected expenses life tosses their way. Plus, they can finally stop relying on bad financial products, like payday loans.

Help employees save where they're already spending.

Whether it's putting food on the table or gas in the tank, Perks gives your team more impact for their money on the things they actually need.

Money smarts made easy.

74% of customers say ZayZoon Financial Wellness improves their financial health with educational courses, smart insights and customized alerts that help them avoid minimum balance and overdraft fees.

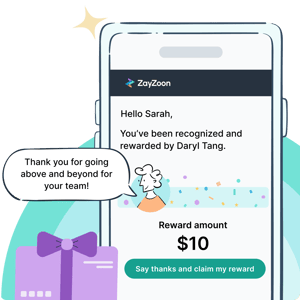

Rewards and Recognition

Employees who receive recognition are 5x1 more likely to be engaged at work and 45%1 less likely to leave. Show your team appreciation that resonates—with the click of a button. ZayZoon makes recognition easy, fast and meaningful.

1 Gallup, 2024

ZayZoon named on the Deloitte Fast 50

ZayZoon has been recognized as a winner yet again in Deloitte's Canadian Technology Fast 50, moving up seven spots to rank 14th.

One financial empowerment platform, tons of employee benefits

The easiest, most effective way to offer on-demand pay, employee perks and financial education to your team.

Choose the perfect plan tailored to your needs. With ZayZoon, you can enjoy our services without spending a dime.

Keep your existing payroll processes. We handle building integrations with payroll processors.

Tired of talking to bots? Us too. At ZayZoon, you get real human support when you need it.

We provide a safe and trustworthy place for your data and have the SOC 2 Type II certification to prove it.

Business leaders trust ZayZoon

“Implementing ZayZoon was seamless. I think I might have been the first paycheck advance requested. It was great. I got my hundred dollars right away and it showed me where it would come off my next paycheck. I didn't have any hiccups at all."

“ZayZoon ensures our caregivers are financially taken care of, so that they can focus on taking care of our seniors.”

"When you have a great culture, you don't have to invest as much in hiring because people know you have a great place to work. Offering benefits like ZayZoon can be the difference between hiring a talented employee or not. I would absolutely recommend ZayZoon to another business. From our perspective, it's been seamless."

What employees are saying about ZayZoon

A part of my ceiling had collapsed and I needed to fix it without cutting into my mortgage. Luckily, I was able to use ZayZoon to handle the cost of the repairs.

My husband was furloughed as a result of the pandemic. ZayZoon helped us put food on the table and pay our bills. We were able to stay afloat until he was back to work.

ZayZoon is convenient when the unexpected expense of everyday life happens. It makes life a whole lot easier.

My life has changed completely. I don't have to depend on others. I can afford to get food, gas, medicine, and pay my bills.

Get your Earned Wage Access program up and running and start reaping the benefits of a better employee experience today.

1 ADP. “People at work report” March, 2025: https://www.adpresearch.com/wp-content/uploads/2025/02/PAW2025_Multiple-Jobs-Final.pdf

2 MNP Ltd. “Ipsos poll November 28 - December 4, 2023.” January, 2024: https://www.ipsos.com/en-ca/mnp-debt-index-declines-current-debt-perception-hits-all-time-low

3 “Run a Successful Business and Focus on Employee Financial Wellness.” Spark, 9 Sept. 2022, www.adp.com/spark/articles/2022/06/obtain-and-retain-talent-run-a-successful-business-and-focus-on-employee-financial-wellness.aspx.

4 Ibid.